We are delighted to bring you our data-backed Costa del Sol Real Estate Market Update for September 2025. This uses the latest releases through July–August 2025.

Costa del Sol Real Estate Market Update

September 2025

We are delighted to bring you our data-backed Costa del Sol Real Estate Market Update for September 2025. This uses the latest releases through July–August 2025.

At-A-Glance

- Sales prices still climbing across the coast; Málaga province up +13.2% YoY in Q2 2025 to €2,510/m² (appraised values). (Tinsa)

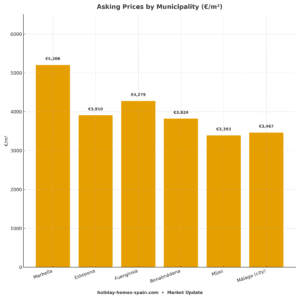

- Prime municipalities (asking prices, Jul-2025): Marbella €5,206/m² (+6.6% YoY), Estepona €3,910/m² (+13.0%), Fuengirola €4,279/m² (+19.2%), Benalmádena €3,824/m² (+17.1%), Mijas €3,393/m² (+14.7%), Málaga city record €3,467/m² (+14.2%).

- Rents at or near records: Málaga province €16.7/m²/mo in Jul-2025 (+9.2% YoY); Marbella €20.0/m²/mo in Aug-2025 (+8.8% YoY).

- Financing tailwind: 12-month Euribor averaged ~2.11% in Aug-2025 (down ~1.05 pp YoY), helping mortgage approvals surge. (euribor-rates.eu, Cadena SER)

- Foreign demand is pivotal: ~35% of Málaga purchases by non-residents; in Marbella’s luxury tier it can exceed 90%. (Puntocomunica: Comunicación 2.0, malagahoy.es)

- Policy watch (Málaga city): 3-year moratorium on new tourist-rental licences now active, likely to re-balance long-term rental supply. (Cadena SER, malagahoy.es)

Prices & Activity

- Appraised values: Málaga province up +13.21% YoY in Q2-2025 to €2,510/m² (Tinsa IMIE). Spain overall: +9.8% YoY. (Tinsa)

- By municipality (asking prices, Idealista, Jul-2025):

Marbella €5,206/m², Estepona €3,910/m², Fuengirola €4,279/m², Benalmádena €3,824/m², Mijas €3,393/m²—all showing double-digit YoY gains except Marbella, which is rising from a higher base. - Luxury/second-home segment: Coastal second homes rose +12.1% YoY in Q1-2025; Costa del Sol (Málaga) +14.3%—the fastest coastal gain in Spain. (Tinsa)

Rental market

- Province: €16.7/m²/mo in Jul-2025 (+9.2% YoY). Marbella: €20.0/m²/mo in Aug-2025 (+8.8% YoY). Nationally, rents set fresh records this summer. ( El País)

- Drivers: tourism demand + limited long-term stock; Málaga’s tourist-rental moratorium may ease pressure over time, especially in central districts. (Cadena SER)

Financing Conditions

- Euribor 12m: ~2.114% in Aug-2025 (vs. ~3.166% a year earlier), reducing typical variable-rate instalments YoY despite a small uptick in August. Mortgage signings in Málaga jumped >18% in H1-2025. (El País, Cadena SER)

- ECB: cut rates in June; markets expect a hold in September with rates ~2%. (European Central Bank, Reuters)

Supply & New Build

- Permits (Málaga province): 2,482 dwellings visados in Q2-2025, with professionals still flagging a shortage of affordable stock. (coamalaga.es)

- Pipeline: Numerous coastal promotions continue, but delivery lags demand in prime areas.

Foreign Demand & Segments

- Share of foreign buyers: Málaga ~34.7%, among Spain’s highest; luxury share in Marbella reportedly >90%. Mix led by UK, NL, Nordics, UAE/other Middle East, and growing North American interest. (Puntocomunica: Comunicación 2.0, malagahoy.es)

Outlook (Autumn 2025)

- Baseline: Continued price firmness into Q4 on the back of sustained international demand, constrained stock, and still-favourable financing vs. 2023–24. (Tinsa, El País)

- Watch items: Implementation of tourist-rental rules (Málaga city), delivery pace of new-build, and ECB path. Short-term volatility in Euribor is possible, but levels remain far below 2024. (Cadena SER, malagahoy.es, El País)

Notes

- Price levels from portals reflect asking prices; Tinsa IMIE reflects appraised values—use both to triangulate. (Tinsa)

What’s Changed Lately (and Why It Matters)

The last few weeks have been busy on the coast. A court ruling, new rental-registry enforcement, record tourism numbers, and Marbella’s planning progress are quietly reshaping the buy/rent calculus from Málaga to Estepona.

Tax breakthrough for non-EU landlords (late Aug): Spain’s National Court held that non-EU owners renting out Spanish property can deduct real expenses (maintenance, insurance, interest, taxes, etc.). That brings UK/US/Canadian owners in line with EU/EEA treatment and can materially improve net yields. Early legal commentary also notes potential refund claims for past years.

“100% complementary transfer tax” still a live proposal (mid-Aug updates): Madrid’s draft extra tax on non-EU, non-resident purchases of resale property (new build generally excluded) remains under debate. It’s not law, but it’s relevant for timing and deal structure while Parliament deliberates.

Short-term rental registry moves from theory to practice (July–Aug): Spain’s new national registry for short-stay lets started full operation 1 July, with high rejection rates in the first two months as authorities filter non-compliant listings—important if your investment case relies on tourist rentals.

Tourism heat stays on (August): Málaga province hotels hit 92%+ occupancy in August, with 65% international visitors—supportive for both nightly and seasonal rental demand into autumn.

Marbella planning advances (July): The council’s new PGOM framework progressed in early July, signaling more flexible land use and a clearer pipeline for future projects—good news for delivery of quality stock (and for due-diligence clarity) over the next few years.

Quick implications by buyer & budget

EU buyers (including Spanish residents):

Stable purchase taxes in Andalucía (7% ITP on resales) and no exposure to the proposed non-EU surcharge. Strong tourism metrics continue to underpin rental demand.

UK / US / Canadian buyers (non-EU):

Near-term positive: the deductions ruling boosts net yields on long- and short-let strategies.

Watch-list: if you’re targeting resales, the complementary tax proposal—if passed—would lift acquisition costs; new builds look relatively insulated in current drafts. Consider reservation/contract timing accordingly.

Compliance: ensure your tourist-let paperwork is immaculate before underwriting rental income. Rejections are happening.

By price band / area (snapshot):

< €500k (apartments in Málaga city, Benalmádena, Mijas): Rental-registry compliance is critical; yields look better post-ruling for non-EU landlords, and August occupancy data supports shoulder-season bookings.

€500k–€1.5m (townhouses & family apartments in Marbella/Estepona): If buying resale and you’re non-EU, factor a regulatory “what-if” buffer in your closing costs. New-build units may offer a cleaner tax path if the proposal advances.

€1.5m–€5m (prime villas in Marbella, Benahavís): The deductions ruling’s absolute € value grows with property size, improving hold-versus-use flexibility. PGOM progress in Marbella should gradually add clarity and supply in prime zones.

€5m+ (ultra-prime): Strategy is less about mortgage or FX sensitivity and more about planning certainty and rental compliance for ancillary income. The current legal tailwind on deductions is meaningful for villa-rental enterprises.